Using a Private Mortgage to Consolidate Debt in Ontario’s Current Economy

Using a Private Mortgage to Consolidate Debt in Ontario’s Current Economy

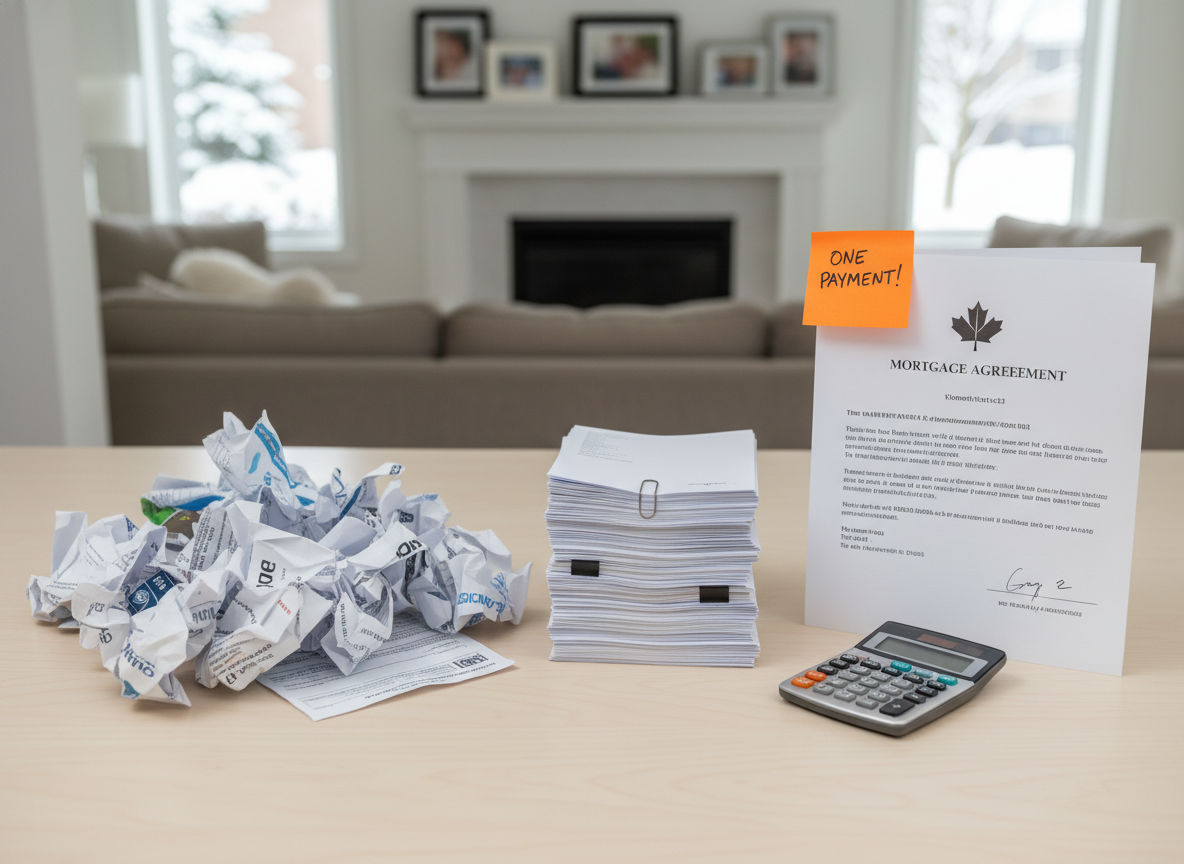

Living costs across Ontario continue to climb, leaving many homeowners stretched financially. While expenses—from groceries to utilities—rise steadily, incomes often remain unchanged. This forces households to juggle credit card debt, lines of credit, and overdue bills. In today's economy, managing multiple high‑interest debts can quickly become overwhelming. One option homeowners are increasingly using is consolidating debt with a private mortgage.

Rising Living Costs vs. Stagnant Income in Ontario

Ontario's economy is putting pressure on many residents. Costs for housing, transportation, and daily necessities have increased significantly, but wages have not kept pace. This gap often leads to more revolving debt, such as credit cards and personal loans, which typically carry high interest rates and compound over time. When these debts accumulate, cash flow suffers and missed payments or collections can follow.

If you are a homeowner seeking relief, traditional bank refinancing may be limited—especially if your credit score has been affected by existing debt or late payments. Private mortgages can be an alternative worth considering.

What Is a Private Mortgage and How Does It Work for Debt Consolidation?

Unlike mortgages from banks and credit unions, private mortgages are provided by non‑bank lenders. These lenders base decisions primarily on the equity in your property rather than solely on your credit score, which can open financing options for homeowners who would otherwise have difficulty qualifying.

Using a private mortgage to consolidate debt means rolling multiple high‑interest obligations—credit cards, lines of credit, and personal loans—into a single mortgage secured by your home. The potential benefits include:

Lower monthly payments: A single, typically lower, monthly payment compared to multiple minimum payments.

Improved cash flow: Reduced monthly obligations free up cash for essential living expenses.

Reduced interest growth: Converting revolving, high‑interest debt into a fixed mortgage can stop rapid interest compounding.

Avoiding collections: Consolidating debt promptly can prevent accounts from going to collections, protecting your credit.

Because private lenders focus on home equity, borrowers with less‑than‑perfect credit may qualify for consolidation if the property has sufficient value.

Why Private Mortgage Consolidation Is Especially Smart in Today’s Economy

Given the current economic pressures on Ontario homeowners, private mortgage consolidation can be a practical strategy. Banks have tightened lending criteria, and interest rates remain volatile. Private lenders can provide a flexible alternative that better reflects a borrower's equity and circumstances.

This consolidation approach helps regain financial control without resorting to additional unsecured loans or credit lines. It directly addresses cash‑flow challenges as everyday expenses increase. Many private lenders are willing to work with borrowers to create repayment plans tailored to individual budgets.

About Trillium Mortgage: Trusted Expertise for Ontarians

Trillium Mortgage is a private lending specialist in Ontario focused on helping homeowners navigate debt consolidation through private mortgages. With industry experience and knowledge of local markets and regulations, Trillium Mortgage provides solutions designed to be effective and compliant.

By connecting clients with experienced private lenders, Trillium Mortgage helps homeowners simplify their finances and overcome traditional credit hurdles. You can learn more about their services from their website.

In summary, if you are an Ontario homeowner burdened by multiple high‑interest debts, a private mortgage can help you combine balances into one manageable payment, reduce monthly costs, halt compounding interest, and avoid collections. With accurate information and expert guidance, you can regain financial stability even as living costs continue to rise.